To use the Hub Testing Integration System (HITS), you’ll need the following:

You’ll also need a basic knowledge of SIF REST:

You need to know how to work with a use case in HITS and access the HITS API

If you get stuck: drop us a line at info@nsip.edu.au

Allow schools to carry out financial transactions using draft SIF Financial objects, including purchase orders, receipts, invoices, journalling, and payments. More…

A 3rd Party Finance application connects to HITS as a jurisdiction hub, collecting the relevant information and publishing back finances records to the centralised system.

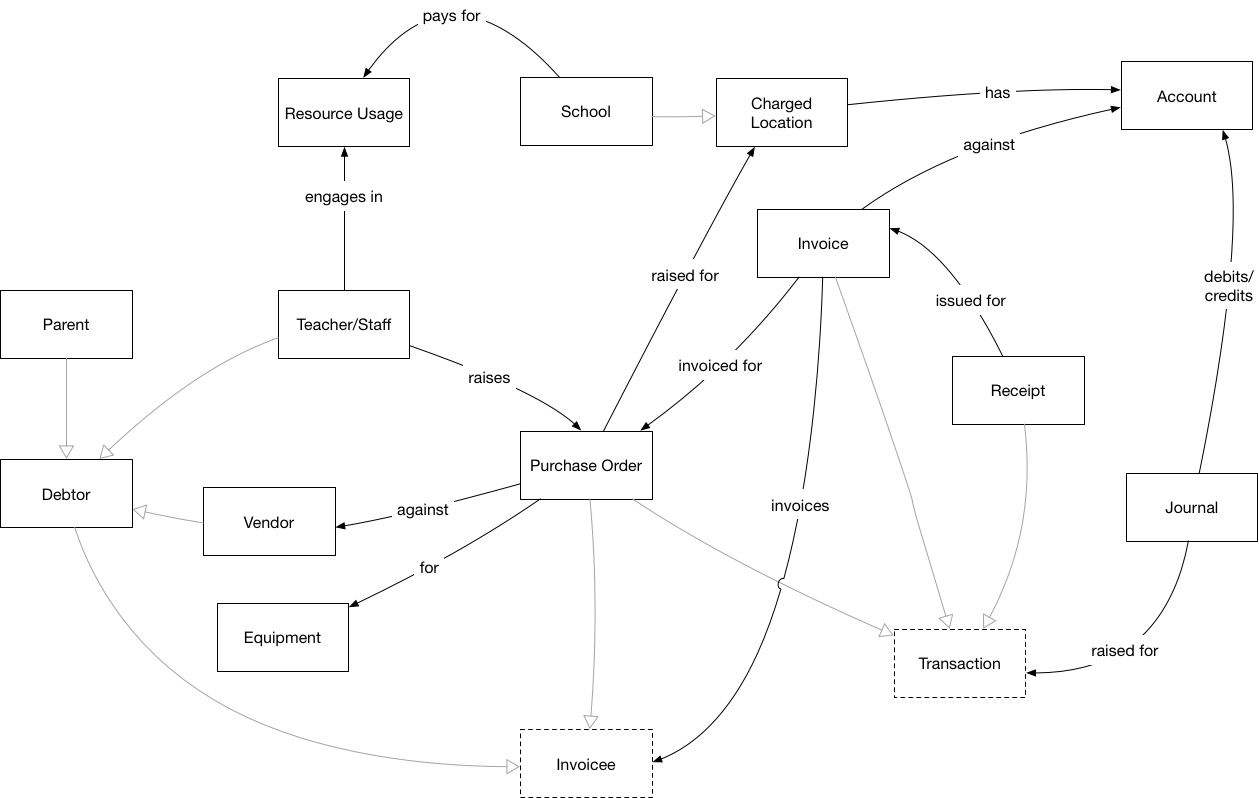

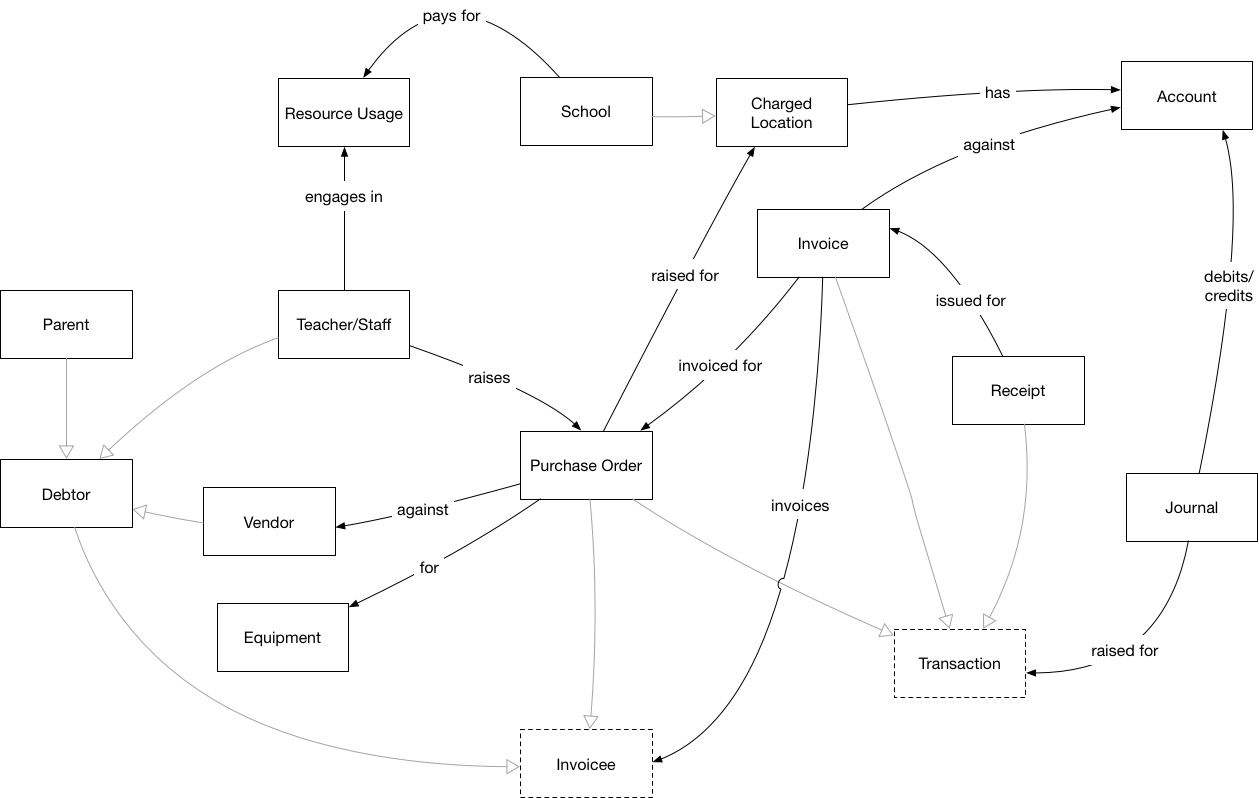

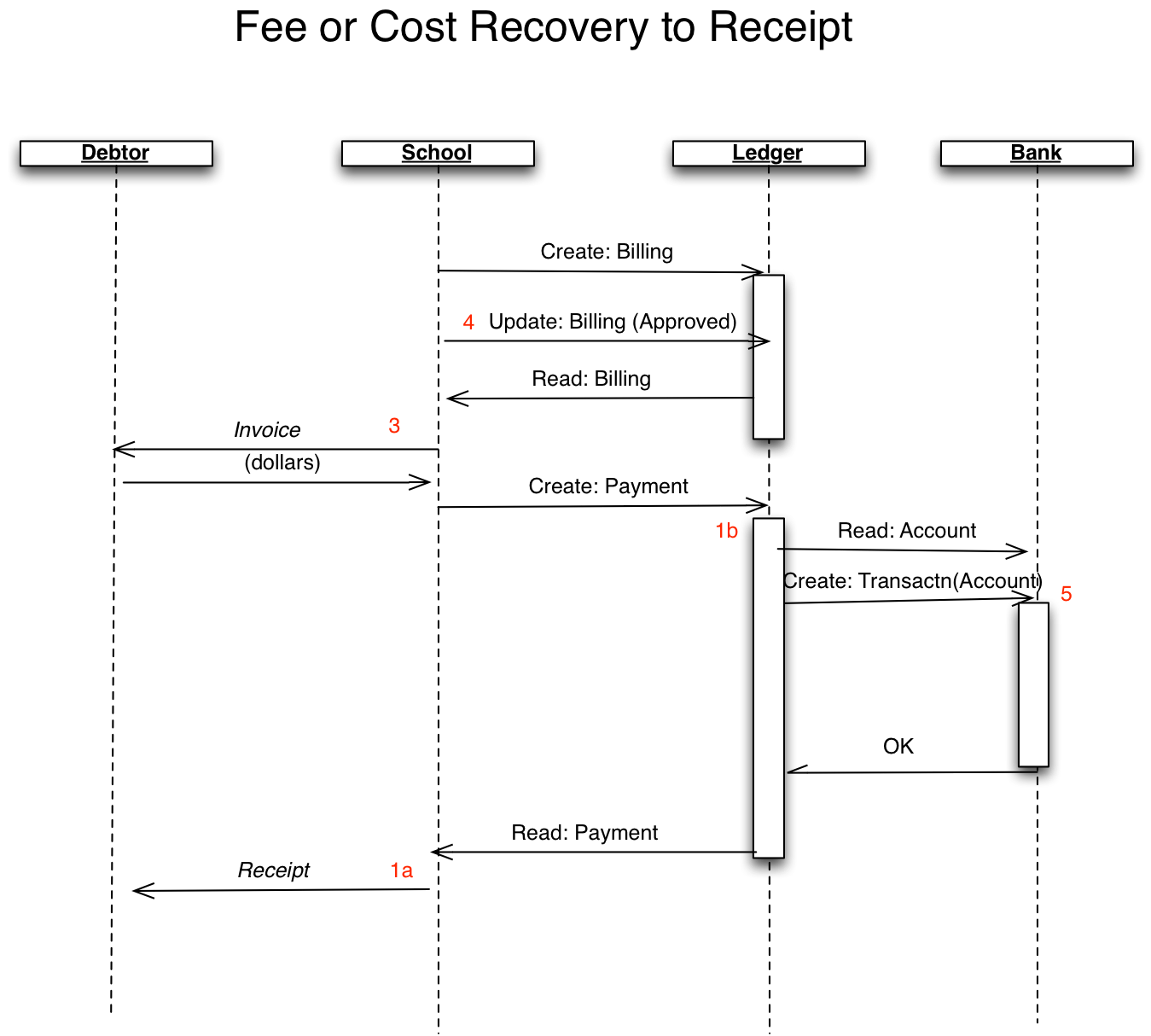

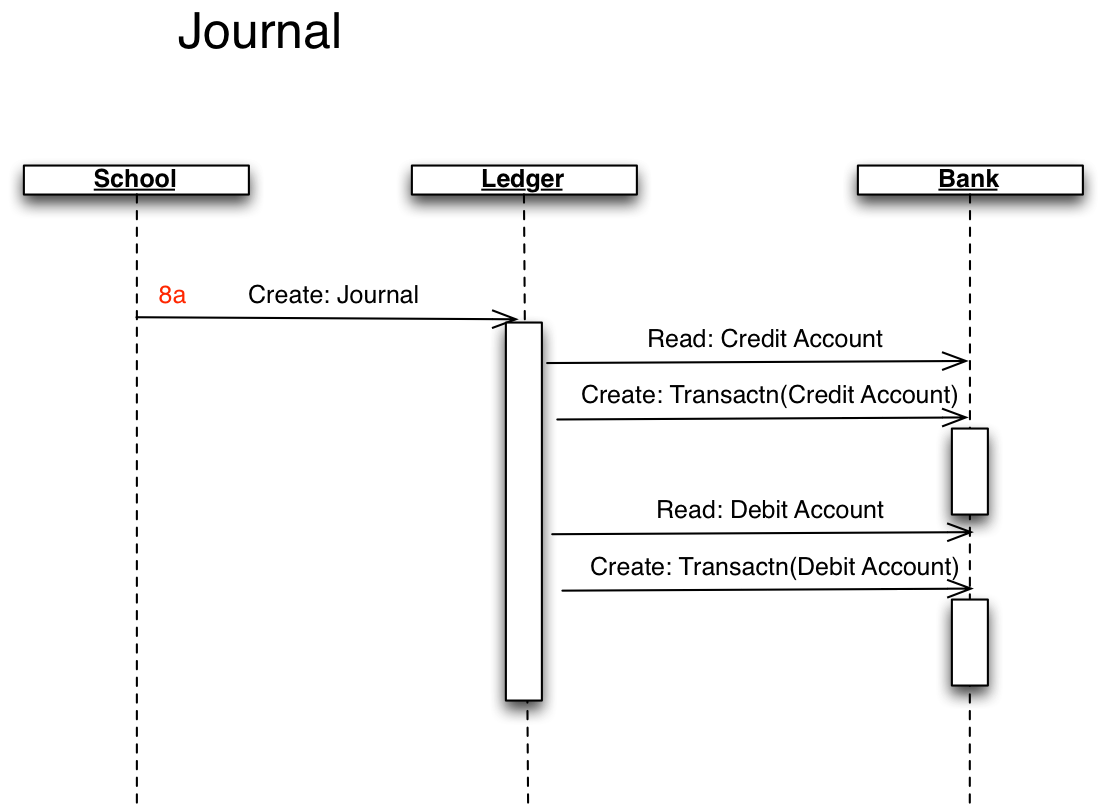

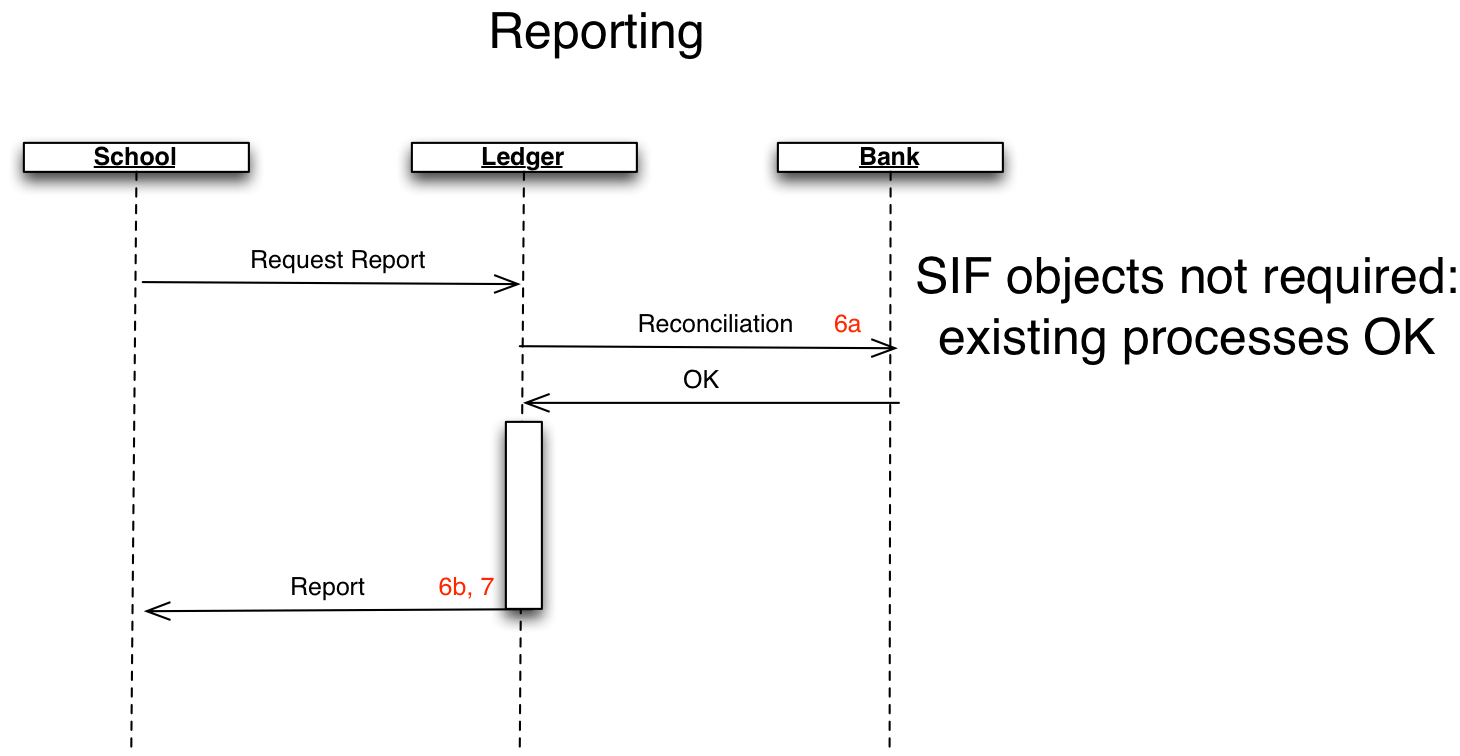

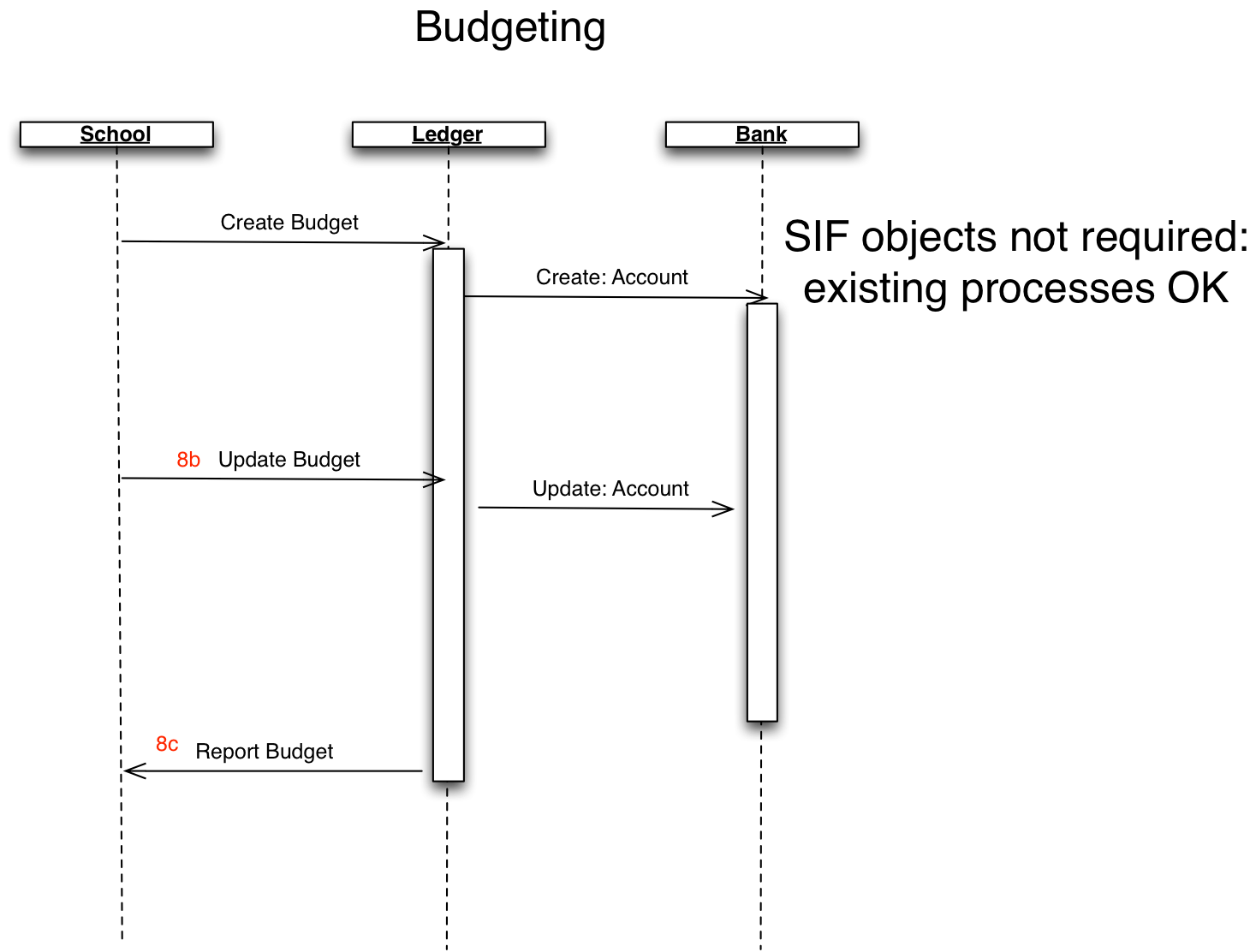

The following diagram gives some wider context around school-level interactions for this use case. Note that some possible interactions shown here may not be covered within this technical use case.

This diagram shows the data flows for finances between student, school and vendors.

3rd Party Vendor is a current supplier of a Finances product in schools or has knowledge of finances reporting processes in K-12 Schools.

3.1. Join

3.2. Consume

3.3. Process

3.4. Provide

3.5. Assurance

Join:

Vendor-facing (pull); HITS represents the Jurisdiction and is the data source for seed information.

(The following is a list of calls that need to be made to consume the required information)

http://.../FinancialAccountshttp://.../VendorInfoshttp://.../Debtorshttp://.../ChargedLocationInfoshttp://.../StaffPersonalshttp://.../StudentContactPersonalsEndpoints may support additional queries for retrieving data - refer to Query-by-example or service paths for HITS guidance on queries.

3rd Party App uses the consumed data to generate appropriate transaction information. The definition and automation of this process is out of scope of HITs.

Steps:

Prior to providing:

Third party expresses return information in SIF/XML:

http://.../Invoiceshttp://../PaymentReceiptshttp://../PuchaseOrdershttp://../JournalsThe SIF/XML data sent by the 3rd Party app to the Jurisdiction Zone for the app must satisfy the following conditions: - Any SIF object published by the App must be valid against the SIF-AU 3.4 schema - All mandatory elements of the submitted SIF objects are provided - All SIF objects posted by the App must have referential integrity. Any RefId contained in the SIF object must refer to a SIF object provisioned to the App—e.g. AccountingPeriod, FinancialAccount—or to another SIF object posted by the App (e.g. Payment referring to Billing).This condition applies recursively to all additional SIF objects posted by the App. The test of this condition is done only when the App indicates that it has finished publishing to the Zone the objects required for the test.

This use case responds to the growing interest in using SIF AU to exchange financial data. Anyone seeking to engage with this use case is encouraged to familiarise themselves with the proposed SIF AU financials objects.

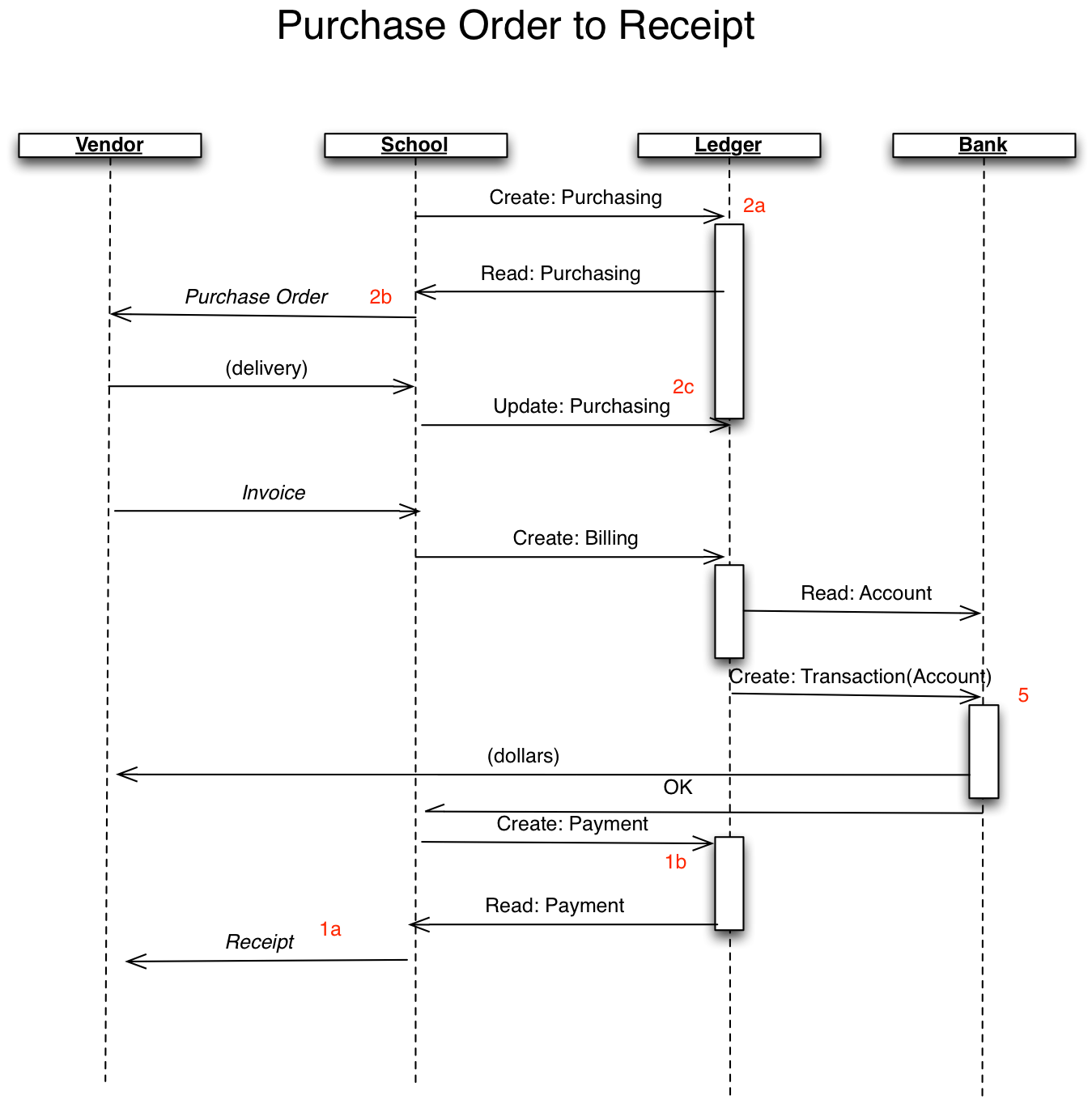

This use case assumes that SIF is required only to exchange information about individual transactions (e.g. purchase orders, invoices, receipts, journals), and that reporting will be done out of existing applications—although those reports may be based on the transactional information received through SIF.

This use case assumes that payroll transactions are out of scope; payroll has not been modelled in SIF-AU as of this writing.

This use case presupposes that there are processes in place for transactions to take place with external parties (debtors and creditors); it does not specify any mechanisms outside of SIF. A purchase order for example may be transmitted to a vendor as a SIF Purchasing object, or as a printed document drawing on information included in the SIF Purchasing object. The mechanisms for generating and sending such a printed document are outside the scope of this use case, and would be provided by existing financial applications.

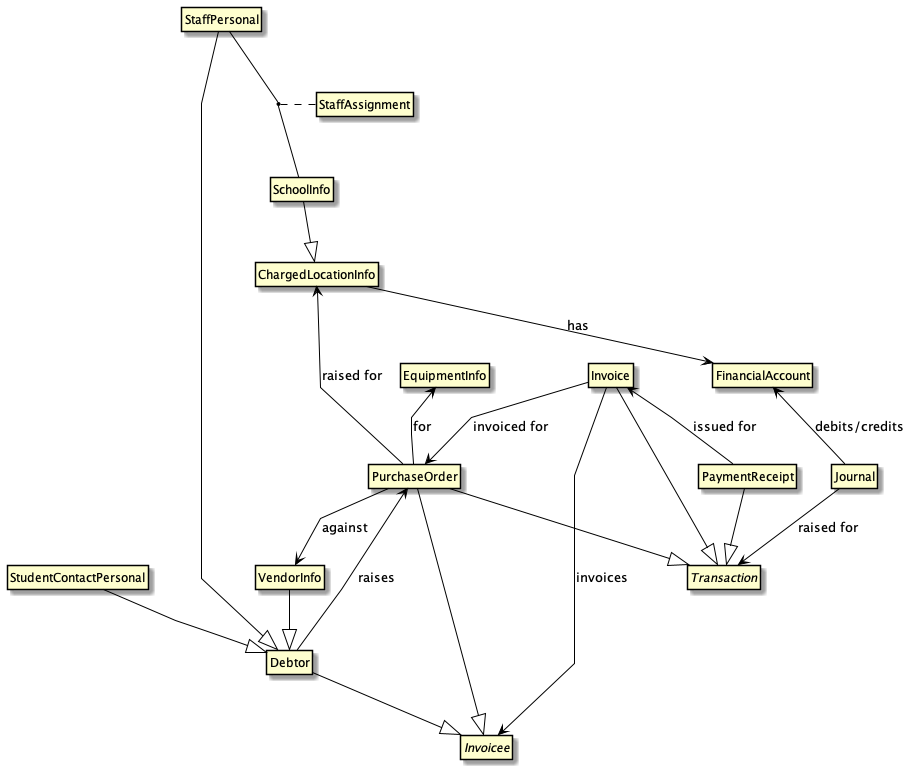

The following lists the priority areas of interest in finance (numbers in parentheses refer to the diagrams below) :

The following three workflows are SIF-based exchanges which realise most of these priority areas:

The following two workflows represent reporting processes which do not require SIF support, as they are already internally to common financial applications:

None.

<SchoolInfo>

<LocalId>{schoolCode}</LocalId>

</SchoolInfo>

<StaffPersonal>

<LocalId>{eNumber}</LocalId>

</StaffPersonal>

<FinancialAccount>

[<ParentAccountRefId>{refid}</ParentAccountRefId>]

<AccountNumber>{number}</AccountNumber>

<ClassType>{type}</ClassType> <!-- TBD -->

</FinancialAccount>

<VendorInfo>

<Name>{name}</Name>

[<CustomerId>{number}</CustomerId>]

[<ABN>{abn}</ABN>]

</VendorInfo>

<Debtor>

<BilledEntity SIF_RefObject="{objectclass}/>

</Debtor>

<ChargedLocationInfo>

<LocationType>{type}</LocationType>

<LocalId>{id}</LocalId>

</ChargedLocationInfo>

<StudentContactPersonal>

<LocalId>{id}</LocalId>

<PersonInfo>

<Name>

<FamilyName>{familyName}</FamilyName>

<GivenName>{givenName}</GivenName>

</Name>

</PersonInfo>

</StudentContactPersonal>

<StudentContactRelationship>

<StudentPersonalRefId>{refid}</StudentPersonalRefId>

<StudentContactPersonalRefId>{refid}</StudentContactPersonalRefId>

</StudentContactRelationship>

<Invoice>

<FormNumber>{number}</FormNumber>

<BillingDate>{date}</BillingDate>

<DueDate>{date}</DueDate>

</Invoice>

<PaymentReceipt>

<TransactionType>{type}</TransactionType>

[<VendorInfoRefId>{refId}</VendorInfoRefId>]

[<DebtorRefId>{refId}</DebtorRefId>]

<TransactionDate>{date}</TransactionDate>

</PaymentReceipt>

<PurchaseOrder>

<FormNumber>{number}</FormNumber>

[<VendorInfoRefId>{refId}</VendorInfoRefId>]

</PurchaseOrder>

<Journal>

[<DebitFinancialAccountRefId>{refId}</DebitFinancialAccountRefId>]

[<CreditFinancialAccountRefId>{refId}</CreditFinancialAccountRefId>]

</Journal>